Monthly CIO Update | AUGUST 2025

By Shival Bajpay

MARKET WRAP

The S&P 500 set 12 new all-time highs in July, underscoring strong momentum in equity markets.

Despite prior volatility from Q1 tariff shocks, volatility remains low, reflecting investor complacency or confidence.

Risk appetite has returned, but the speed of this recovery and market pricing a goldilocks scenario leaves limited margin for error.

• Relying on passive exposure may mask meaningful underperformance across sectors. Tech stocks are up 24% since Q1, driven by AI enthusiasm and strong earnings. Small caps and value-oriented sectors have lagged, reflecting concerns about macro headwinds and refinancing risk. Despite index-level strength, this is a top-heavy market with mega-cap dominance continuing (e.g., MSFT and NVDA far outpace S&P and Russell 2000).

• Near-term upside may be capped unless earnings reaccelerate.

Interest rates, Inflation, Labor Market, Yield Curve

INVESTMENT OUTLOOK

The S&P 500 forward earnings yield has declined, now well below historical average, implying stretched equity valuations. Despite high nominal money market balances (~$7T), cash is underweight relative to equities vs historical norms. Investors have rotated back into risk, and the rally + elevated valuations are being funded by reallocation, not sidelined cash. This limits the potential for another “cash-on-the-sidelines” boost.

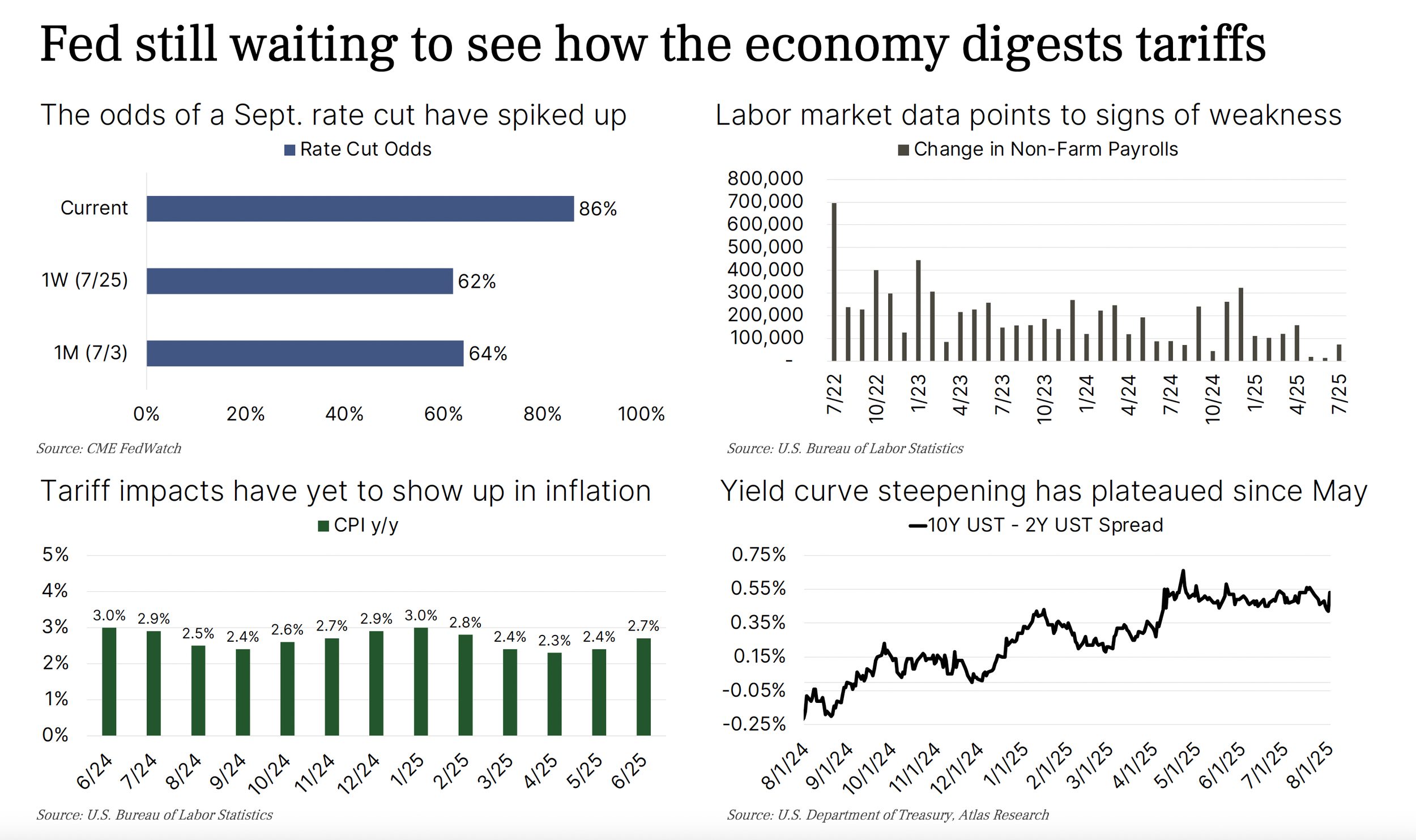

• The Fed is hesitant to make a move without seeing how the economy digests the highest effective tariff rate since WWII. Inflation appears anchored as tariff impacts have not yet flowed through to CPI. Still, rate cut expectations for September have surged as the labor market data show slowing job gains.

CHART OF THE MONTH

Not all alts are created equal. Private market alpha is increasingly driven by exposure to top-tier funds. Being in the “right” asset class but with the wrong manager leads to dramatically lower returns. The difference between top- and bottom-quartile managers in PE is as high as 17 percentage points in IRR.

Reinforces the need for rigorous manager selection, rather than merely providing blind access to alternatives.

Manager’s performance gap